The purchase agreement was signed today with the previous owners, a consortium led by financial investor EQT. Subject to competition-law clearance of the acquisition and other regulatory prerequisites, it is expected to become effective at the end of the third or beginning of the fourth quarter of 2023. The enterprise value of BBS Automation is between €440 million and €480 million and depends on the development of results in 2023. Financing will be provided from cash flow as well as through existing financing instruments and a bridging loan.

Strengthening the global setup

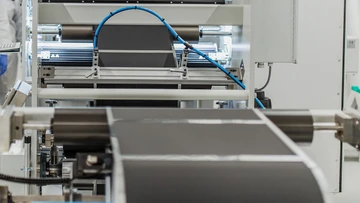

BBS Automation, founded in 2013 and headquartered in Garching near Munich (Germany), has around 1,200 employees and 14 locations in Europe, Asia, and North America. These include highly efficient engineering and production sites. Around 55% of BBS Automation’s sales in 2023 are expected to be attributable to systems for the production of automotive components, especially for the e-mobility sector. Examples include electrical components, batteries, and elements for brakes and lighting. About 20% are expected to be generated from systems for the production of medical devices such as syringes, inhalers, and pharmaceuticals. In the consumer goods sector, for example, hearing aids and electric toothbrushes are produced on machines from BBS Automation.

Automation technology as important growth sector

Automation technology is one of the most important growth sectors for Dürr. The Group had already acquired the automation experts Teamtechnik and Hekuma in 2021. With BBS Automation, the range of products is once again significantly expanded. The accessible market volume is expected to grow by an average of 9% in the next years. Growth drivers are the labor shortage, ever higher quality requirements and unit numbers in mass production, increasing wealth in many world regions as well as the e-mobility boom and — in the medical devices sector — the growth and the aging of the world’s population.

New powerhouse for automation, synergies planned

The combination of BBS Automation, Teamtechnik, and Hekuma creates one of the most powerful suppliers in the highly fragmented market for automation solutions. “We are forming a new powerhouse for automation. The products and software offered by the three companies complement each other perfectly, enabling us to make even better offers to customers all over the world,” says Group CEO Dr. Jochen Weyrauch. Under the umbrella of the Dürr Group, the three companies are set to benefit from synergies and economies of scale, for example in the areas of sales, development, purchasing, service, and production. This is expected to lead to efficiency and margin gains.

Expansion of automation technology accelerated

The Dürr Group originally announced a sales increase to up to €500 million by 2030 as its target for automation technology. With the acquisition of BBS Automation, this target is now expected to be reached as early as in 2024. The cooperation with Teamtechnik and Hekuma under the umbrella of the Dürr Group creates further potential for growth and improvements in earnings.

“Dürr’s automation business will benefit from better customer access, and efficient engineering and production capacities. There is further growth potential in the e-mobility business as well as in the medical technology and consumer goods sectors. The growth and planned synergies will lead to sales increases and profitability gains,” said Josef Wildgruber, founder of BBS Automation, who will continue to manage the business within the Dürr Group.

BBS Automation is targeting sales of around €300 million in 2023. For 2026, sales of between €400 million and €450 million and an EBITDA margin of 13% to 15% are expected. This means that the acquisition is in line with the Dürr Group’s growth and earnings targets.

Completion of the acquisition in the fall of 2023

The business figures of BBS Automation will not be reflected in the Dürr Group until the transaction is completed in the fall of 2023. Therefore, the acquisition has only a minor impact on the Dürr Group’s sales and earnings in the current fiscal year. Solely the forecast for the net financial status as of December 31, 2023 has been adjusted in line with the enterprise value of BBS Automation and now stands at €-490 million to €-540 million (before: €-50 to -100 million). The automation business of BBS Automation, Teamtechnik, and Hekuma will continue to be managed in the Paint and Final Assembly Systems division within the Dürr Group.